public bank atm withdrawal limit

If you need to withdraw more money from your. Most banks set their daily ATM withdrawal limit from 300 to 2500 for each business day.

Withdraw Cash From Atm Without Using Debit Card Personal News India Tv

If you keep your money at one of the 20 largest banks in the country your checking account likely will have a daily ATM withdrawal limit between 300 and 5000.

. An ATM can only hold so much cash so a daily limit keeps a. OCBC Citibank Standard Chartered Bank SCB United Overseas Bank UOB and HSBC RM100 per transaction 8. There is a per-transaction withdrawal limit of 400.

19 rows Its common for atm limits to be 50000 or even lessive seen limits as low as 15000 and. Major hotels take debitcredit cards but cheaper accommodations tourist sites and smaller restaurants tend to only take cash. Some financial institutions have daily limits lower than.

Citi Bank still offers unlimited free transactions. However multiple transactions can be completed until the maximum withdrawal limit set by your financial institution is reached. For an example the maximum cash withdrawal limit for the most basic account type for one bank could be Rs25000 per day whereas another bank could.

Amount to be withdrawn should be divisible by 100. If you often need more than your accounts limit you can ask about daily ATM limits when choosing your bank. The limits vary depending on which bank you use and what type of account you have.

RM100000000 per transaction for residents RM1000000 per day for non-residents 3 Payment reference. It is to be kept in mind that transactions include both financial and non-financial transactions at ATMs. Bank of America on the other hand allows for up to 1000 or 60 bills at one time in daily cash withdrawals and most Citibank accounts allow for up to 1500 depending on your account.

Overseas ATM cash withdrawal limit and an activation period. You could also upgrade your account to a more preferred account. RM3000000 combined limit with DuitNow Transfer Interbank GIRO IBG and Intrabank Fund Transfer prepaid reload purchase and cash withdrawal.

This means multiple transactions are often needed and your own bank transaction fees can add up. How do I make a Cardless Withdrawal request. Many checking and savings accounts impose a daily limit anywhere from 300 to 1500 or more on ATM cash withdrawals.

20 rows Your ATM max withdrawal limit depends on who you bank with as each bank or credit union. Keep your Automated Teller Machine ATM card safe. The daily ATM withdrawal limits for premium accounts tend to be higher than for basic accounts.

The maximum withdrawal limit can vary because it depends on your account and your relationship with US. There are two main reasons behind ATM withdrawal limits. Public bank atm withdrawal limit Home.

For example Citibanks regular checking account has a 1000 daily withdrawal limit and 5000 daily debit card payment limit. Daily ATM withdrawal limits can typically range from 300 up to 3000 a day and even more If you need more cash than your daily limit allows you can try to request a temporary increase in your daily limit Use a debit card cash advance to withdraw funds or get cash back with a purchase at the store. This limit still applies if you go cardless meaning instead of using a card you are able to wave your mobile device next to the.

Minimum amount PhP100 per transaction Maximum amount PhP10000 per transaction Maximum amount per day PhP30000 Note. So banks set daily limits to ensure they have the funds to cover daily withdrawals. Keep an eye on your bank account balance.

Another reason is that most banks limit how much cash they have on-site. RM100 per transaction - Islamic Foreign Banks IFBs eg. Does anyone know how to change the atm daily withdrawal limit to over 5000 per day for public bank.

The atm machine can only set maximum withdrawal limit 5000 per day. Very easy onlyu perform the transfer at MAYBANK ATM with your PUBLIC BANK ATM CARD and your maybank account will get the fund instantlySo now RM5000 Public Bank withdrawal RM5000 Maybank withdrawal RM10000 Perform it continuously for 3 day then you should be able to withdraw RM30000. 25056 Riding Plaza Chantilly VA 20152.

Inform your bank immediately if you lose your ATM card or in case of any suspicious transactions or situations. You may only withdraw a specific amount of cash from an ATM daily. Partial withdrawal is not allowed.

However your specific daily ATM withdrawal limit will depend on the bank and the type of account. Written by Published on 8282020. Amount requested should be the actual amount to be withdrawn from the ATM.

Every major bank in the United States has an ATM withdrawal limit a cap on the amount of cash you can withdraw each day. The Citigold account has a 2000 withdrawal limit and a 10000 debit. MESSAGES FROM BANKS Check the transaction records provided by your bank in a timely manner.

These limits are specific to banks and the different types of account they offer. Withdrawal limits depend on the bank but average out at around 1500 RM per transaction and 3000 RM per day. The rule is applicable for customers in Bengaluru Mumbai Chennai Kolkata Delhi and Hyderabad.

ATM withdrawal limits can differ from person to person however and they are often determined by a number of factors including what type of account or product it. Cash Withdrawal via ATM at-- MEPS Member Banks. Some banks limit daily cash withdrawals to 300.

The ATM withdrawal limit at some banks can be as high as 5000 while others will only let you withdraw 300 per day. Most financial institutions have a daily ATM withdrawal limit of 300 to 3000. Bank ATM cards the withdrawal limit is 500 which is within the range of typical card limits for most banks.

The maximum fee which can be charged is Rs20. Al Rajhi Bank and Kuwait Finance House RM100 per transaction - Locally incorporated Foreign Banks LIFBs eg.

Bank Atm Alert Machine Did Not Dispense Cash Yet Amount Debited From Your Account Do This Fast Zee Business

Atm Banking First National Bank

Atm Rule Change Now Pay More To Withdraw Cash From Atms Key Things To Know

Understanding The Differences Between Debit Card Atm Card And Credit Cards

Pin On Seth Cohen Core3 Slovakia

Icici Bank Loan Emi Moratorium How It Works And The Charges Icici Bank Bank Loan Banks Website

Want To Remove Money From Bank Atm But Forgot Your Debit Card You Can Still Do It Here S How Zee Business

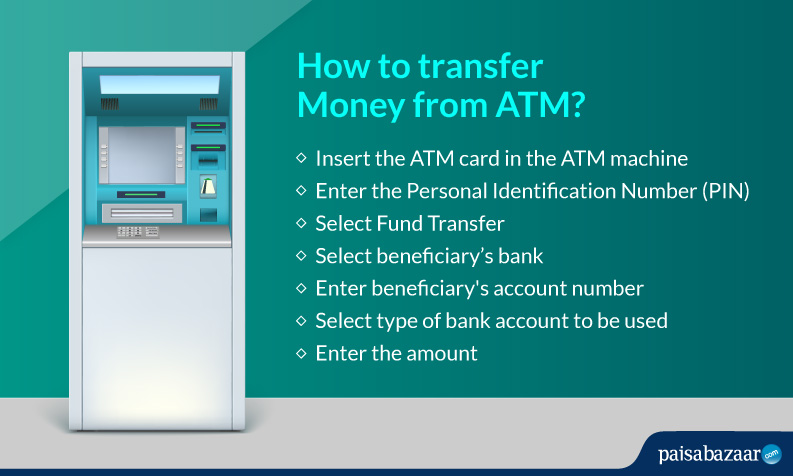

How To Transfer Money From Atm Account To Account Fund Transfer

Convert Normal Saving Bank Account Into A Corporate Salary Package Accou Saving Bank Account Savings Bank Accounting

Bank Of America Atm Deposit Withdrawal Limits Gobankingrates

Automated Teller Machine Atm Hands On Banking Financial Education

Bank Account Portability Still Some Time Away Business Line Bank Account Accounting Bank

Using A Bank Machine Atm To Make A Withdrawal Youtube

Bank Atm Card Holders Alert Get Benefits Beyond Cash Withdrawal Here Are Top 5 Advantages That You Must Know Zee Business

Indian Bank Atm High Resolution Stock Photography And Images Alamy

Pin On Ways To Make Money From Home

What To Do If Your Debit Or Credit Card Gets Stuck In An Atm Mint

Did A Bank Atm Just Swallow Your Credit Or Debit Card Don T Worry Just Do This Zee Business